Where is the SMB managed services channel today, as we enter 2016? Since 2013, managed services has taken deep root within the channel, and at the same time, some of the firms that were only casually involved with managed services have pulled back in order to focus in other areas. In the report, The SMB Channel & Managed Services: Success Metrics, Techaisle uses findings from 808 in-depth surveys with US-based channel firms to illuminate conditions within the US SMB managed services channel, and to develop perspectives that suppliers (and the channel itself) can use to construct successful managed services channel strategies. The survey identified a set of issues that is highly correlated with very successful managed services channel businesses, another that can be used to identify partners that are likely to be unsuccessful in managed services, and a third which lacks predictive value.

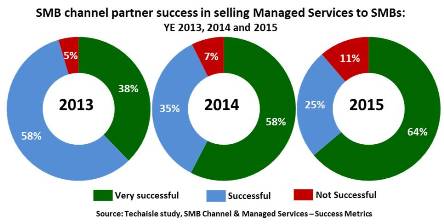

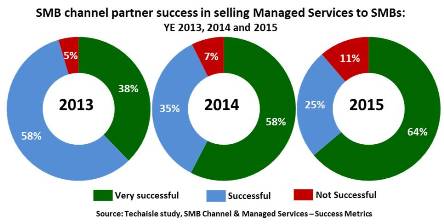

Results from three annual Techaisle channel surveys, shown in figure below, show that the trend towards specialization – in which channel members commit more strongly to managed services, or move away in order to focus on other areas – is well underway. 64 percent of the channel is ‘very successful’ in selling managed services, meaning that the population of very successful managed services channel members has increased by nearly 70 percent since 2013. A much smaller but growing proportion (currently 11 percent, more than double the 5 percent logged in 2013) acknowledges that it is not having success with managed services. MSPs and SPs report the highest level of success in selling managed services, while SIs, consultants and (especially) VARs are see less success.

A view of these findings organized by core business model provides additional insight into the partner communities where managed services are – and are not – gaining traction. As would be expected, managed service providers themselves are most likely to report success in managed services sales. Beyond this group, there are several interesting observations contained within the data:

- Nearly three-quarters of service providers state that they are “very successful” at selling managed services. This is an important issue within this community: SPs increasingly rely on managed services to differentiate their core hosting or connectivity services, which are (in many cases) relatively low-margin, and which offer limited prospects for future growth. Perhaps the most interesting finding for SPs is that 18 percent consider themselves to be unsuccessful in selling managed services. This group will be at risk as they compete with firms that augment core service presence with expanded, high-margin service portfolios that lock in an increased share of ‘customer wallet’.

- SIs are not especially aggressive in this space. At a high level, this data makes intuitive sense: SIs tend to have engagements that have a fixed duration and deliverable and managed services involve longer-term relationships tied to SLAs rather than functional specifications. However, it might be expected that SIs facing a shrinking product delivery market (due to increased use of cloud) might look to solidify customer relationships via managed services. The data shows that some SIs are following this path, they are either not committed to this strategy or are actively pursuing other options.

- Consultants and (especially) VARs are tepid in their pursuit of managed services business. Corresponding 2016 channel reports from Techaisle (see details below) show that VARs are finding great success in cloud, while consultants report that they are experiencing high levels of mobility sales success. Neither group seems particularly enthralled with managed services

It’s clear to all of us that today’s IT industry is comprised of many ‘moving pieces’. This is especially true in the SMB segment: with cloud, mobility and managed services, the buyer’s options have expanded; with the increased involvement of non-IT managers (in both ‘real’ and shadow IT), the buyer community has expanded; and with the channel’s struggle to understand and act on the new cloud-driven demands of a post-transactional IT market, the supply chain itself is undergoing tremendous change.

Techaisle is committed to working with the IT industry to ensure that these changes result in increased opportunity. Techaisle has recently completed two large-scale surveys – one of channel partners (VARs, SIs, MSPs, SPs and IT consultants) and another of SMBs (firms with 1-999 employees). We have also created a thought leadership piece, “Channel Imperatives for 2020: The Changing Channel for a Post-transactional IT market” which examines how 12 tenets of ‘conventional wisdom’ in the channel – mantras like the need to add value, or to increase service revenue, or to focus sales people on retiring quota, or to assemble and deliver best-of-breed solutions – are giving way to new management imperatives. We believe that this research is essential for suppliers looking to plot a channel-centric strategy for SMB market development by capitalizing on the insights contained in our analysis.

The series of three channel focused reports are The SMB Channel and Cloud: Success Metrics, The SMB Channel and Mobility: Success Metrics and The SMB Channel and Managed Services: Success Metrics. Each contains charts and analysis that can be used to identify high-value ‘very successful’ partners and avoid low-value ‘unsuccessful’ channel organizations. They are designed to connect with channel marketing, recruitment and management strategy.