SMB cloud is ubiquitous today and becoming even more so, central to the technology and management needs of both smaller and larger SMBs. Cloud is no longer a trend that is discrete from mainstream IT. Techaisle data shows that cloud is viewed as an IT priority by 96% of US SMBs and 90% of current cloud using SMBs are increasing their cloud usage within the next one year. Cloud is not a future issue, it is an essential component of SMB IT.

While cloud growth has been extraordinary, it is reasonable to expect continued high-trajectory growth resulting from three key factors:

- Cloud is established as essential IT infrastructure

- Cloud addresses real business needs

- Suppliers will work with buyers to overcome current SMB cloud adoption challenges

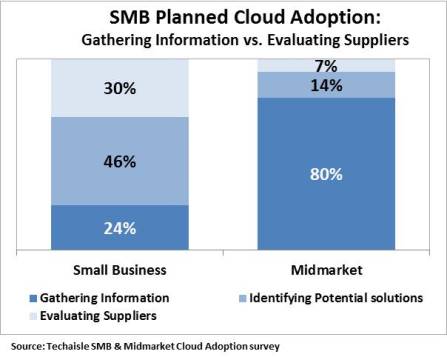

Where are these SMB firms who are planning an expanded cloud presence in the evaluation process? Techaisle asked SMB respondents to identify whether they would refer to themselves as “gathering information,” “identifying potential solutions” or “evaluating suppliers”.

As cloud adoption continues to expand within SMB organizations, Techaisle SMB & midmarket cloud adoption survey data demonstrates that 38% of SMBs are gathering information on cloud technology, solution options and appropriate cloud adoption steps. 32% have moved beyond to the stage of evaluating solutions and the balance are in the process of evaluating suppliers. However, Techaisle believes that these percentages are a moving target as SMBs continue to increase spending on cloud.

Among the midmarket businesses, fully 80% of those planning new cloud initiatives are at this stage, with only 7% focused on evaluating suppliers. Highest percent is within the 100-249 employee size businesses establishing a clear fact that as businesses transition from a small to a larger organization they increasingly gravitate towards cloud to solve their growing pains, establishing processes and supporting a dispersed workforce.

Combining the above information with the data that 94% of midmarket firms are already using some form of cloud solution, we get a picture of a midmarket enterprise market that is in the process of assessing where and how the use of cloud should expand through the enterprise. Small businesses, on the other hand, have a roughly normal distribution across these categories: 24% report that they are gathering information, 46% have moved on to identifying potential solutions, and 30% are evaluating suppliers.

Techaisle believes that the differences between the small and market organization findings reflect different stages of cloud adoption. The small business findings are consistent with a community that moves from point to point, working first on one discrete solution, and then on the next. The midmarket findings are consistent with a community that has already deployed point solutions, and is now trying to build a longer-term strategy for an integrated, flexible approach to incremental cloud expansion. This dichotomous approach is a real challenge for suppliers: they need to differentiate discrete solutions for the small business market, and demonstrate that their offerings are essential components of broader strategies for mid-market firms, while attracting attention to their companies and products and building brand preference in both segments.

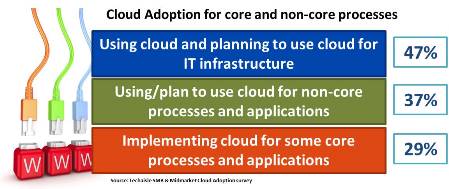

This perspective is reinforced by data showing the current uses of cloud within SMBs. Generally, SMB IT departments have used cloud to supplement IT infrastructure resources – for example, by procuring cloud-based storage to offload data from on-premise drives, or by using cloud for backup. Cloud has also made its way into SMBs as a means of supporting non-core applications and related processes; for example, cloud might be used to automate previously manual tasks in HR or customer support that aren’t linked to financial and production systems. But data from the Techaisle SMB survey finds that use of cloud is expanding even into these business-critical applications.

When SMBs are asked to indicate the areas of their operations where cloud has been or will be applied, nearly half report that they are using/planning to use cloud for IT infrastructure, and 37% state that cloud will be deployed to support non-core processes and applications. However, nearly 30% state that they are using or are implementing cloud to run at least some of their core applications. Given that these core applications are not changed or re-platformed very often, 29% is a surprisingly high figure. Cloud is expanding beyond IT-specific uses and niche applications, and is increasingly seen as a viable platform for even business-critical process support.

The shift in cloud’s positioning and dichotomous approach brings with it a shift in the kinds of insights needed to help connect suppliers and buyers to address common interests in deployment, integration and expansion strategies. SMB buyers need help in moving past initial cloud pilots and applications to integrated cloud systems that provide support for mission-critical processes. Cloud sellers need to adjust their messaging to address the needs of early mass market rather than early adopter customers.