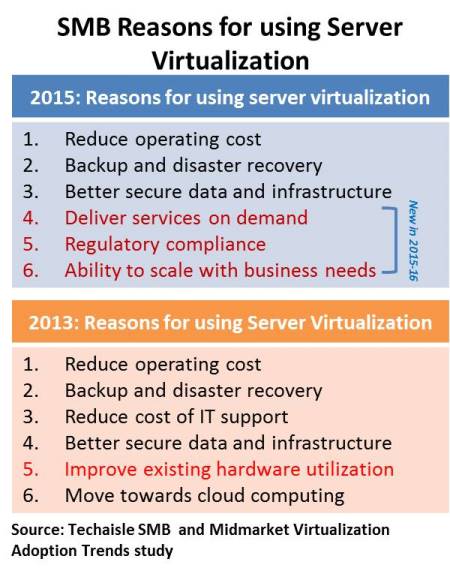

Techaisle’s SMB & midmarket virtualization adoption research shows that some adoption drivers that were less important in 2013 have assumed increased prominence today, some have dropped off while top two have remain constant and consistent. The figure below shows that some of the top issues, including a need to reduce operating costs, to establish effective backup and recovery strategies, and to provide better security for corporate data and infrastructure, were important to SMB buyers two years ago and are still important today.

Two of the 2013 issues have disappeared altogether because they no longer had the same degree of urgency: “move towards cloud computing” is not a driver when the market has already embraced this move, and “reduce energy costs” is less important when power-constrained operations can move processing to the cloud.

“Deliver services on demand” was the ninth-ranked driver of virtualization adoption just two years ago, but today, when “on demand” has become the default mode of delivery, it is the fourth-highest rated adoption driver. Regulatory compliance is another issue that is more important today (ranked fifth) than it was in 2013 (when it was ranked 11th of 13 issues). Scalability, which was added to the 2015 survey in response to increased market interest, debuts as the sixth most compelling reason for server virtualization adoption, while anywhere/any device application access, which is also new to the 2015 survey, is cited as an important adoption issue. On the other side of the balance, the comparison of 2013 and 2015 research indicates that SMB firms are now putting less emphasis on server virtualization as a means of reducing IT support costs and improving utilization of existing hardware. It appears that the issues that are increasing in importance speak to the ability of server virtualization to support key business objectives, while those framed entirely as means of enabling specific types of IT cost control are declining in relative importance.

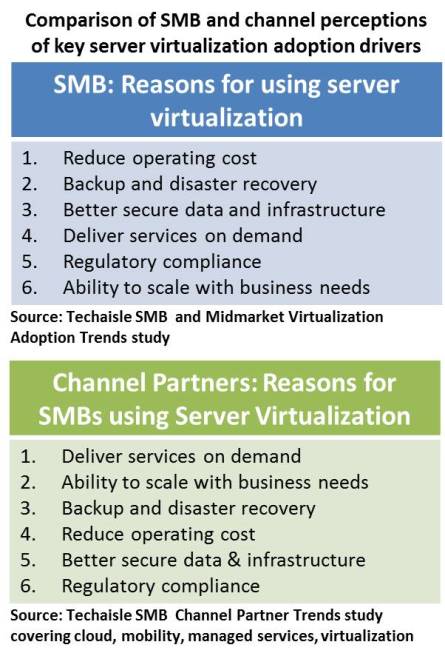

Interestingly, the IT channel – which is the primary source of IT supply and advisory services to mid-market businesses – has a more advanced take on server virtualization adoption drivers than the customer community that it supports. Above figure compares the channel’s perception of why SMBs are embracing server virtualization with the actual user motivations. We see that the channel is more focused on support for advanced business objectives – delivery of on-demand services, scalability, and anywhere/any device application access – than is the user community itself. This suggests that channel members (two-thirds of which reports that they sell/support server virtualization) are attuned to evolving needs, which speaks well of the channel’s ability to continue to promote server virtualization within the SMB market.

Despite the buzz around cloud, most SMB workloads are still hosted and managed on site, and SMBs have a clear need to reduce costs and improve efficiency of back-end infrastructure and to establish better control over mobile resources. Virtualization helps accomplish both of these goals, and converged infrastructure provides a platform that sophisticated SMB users are already finding compelling. Techaisle believes that virtualization and converged infrastructure are poised for strong growth in the SMB market because they address specific high-priority IT and business issues. It’s important to remember, though, that different virtualization technologies are aligned with different requirements. Server virtualization addresses corporate need for controlling cost and uncertainty, while VDI and DaaS provide control options for mobility solutions. Although they stand to benefit from user comfort engendered by server virtualization, VDI and DaaS should not be seen simply as “next steps in virtualization” – they play a different role in business and IT strategy, and as a result, will respond to their own logic.

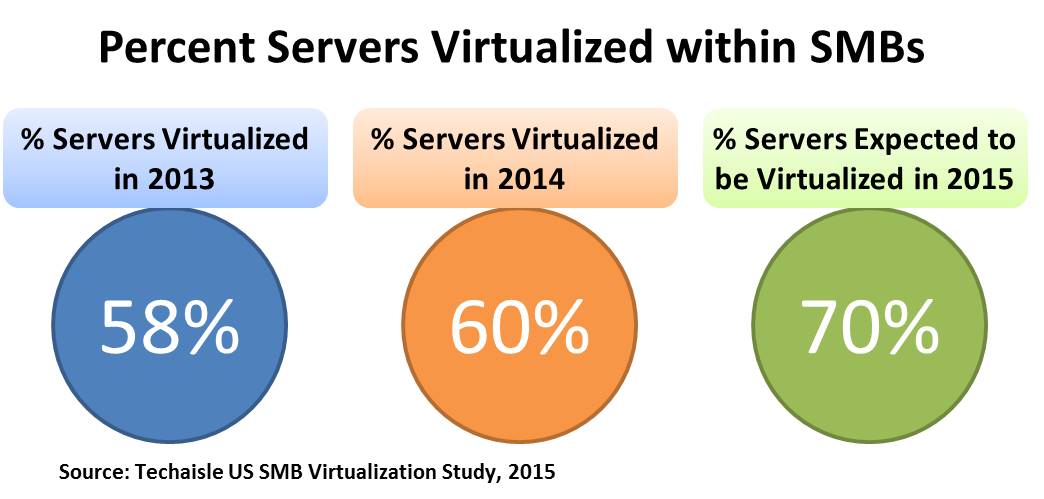

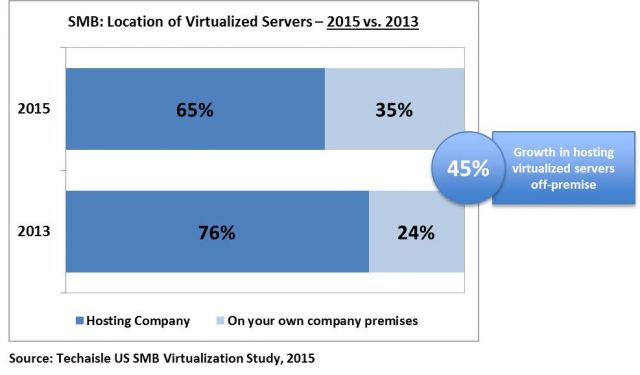

Use of server virtualization is reasonably widespread in the small business market, and nearly universal within midmarket enterprises. Suppliers targeting high-potential server virtualization accounts in the 1-99 employee segment are urged to use Techaisle’s IT sophistication segmentation to identify “Advanced IT” organizations, which are far more likely to be using server virtualization than their “Pre-IT” or “Basic IT” peers. Suppliers are also urged to cultivate relationships with firms that host servers for SMBs, as the growth of virtualization in hosted environments is far higher than growth in on-premise use of virtualized servers.