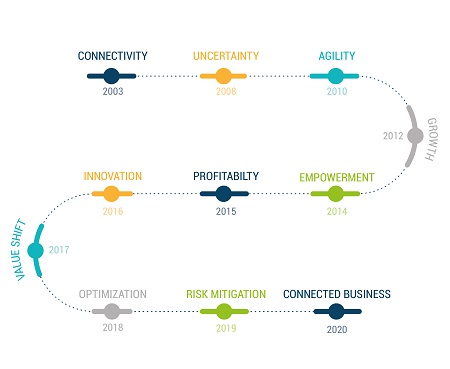

Every year or two (or three), a new trend sweeps the IT industry, and breathless coverage asserts that the new phenomenon has arrived fully-shaped to transform technology and/or IT’s role in business strategy. This is, of course, very rarely true. Most trends play out over a long time, and change in technology tends to be incremental rather than revolutionary. For example – it is certainly true that digitalization (and digital transformation) are important issues today, and that they will have a transformative effect on IT and business strategy. But Techaisle research demonstrates, they are a recent highlight in a series of business issues and technology themes that stretch back at least 15 years, from 2003 to 2019.

Key SMB and Midmarket digitalization themes, 2003-2020

As we enter the next decade, it seems that online capabilities and activities are entering a new era. There are still advances to be made in the ‘net’ realm: there is constant pressure to expand the speed of the Internet, enabling it to handle the voracious demands of unstructured content like video, and the rise of IoT and 5G portends a coming tsunami of data from billions of connected devices. However, the key focus of web-based business investment is now less about the ‘net’ and more about the ‘work’: the ways that an increasingly-connected world supports pursuit of previously-unattainable objectives. The most important IT-related development in 2020 will be this focus on connectedness – connected cloud, edge, applications, security, collaboration, workspaces and insights. Internet and the web are the navigation routes that we have been developing since the 1970s; the always-on, everywhere-connected Interwork© platform is the destination that we will be creating in 2020 and for years to come.

This eBook has been written to provide guidance to supply-side management responsible for digitalization strategies that affect sales and marketing of advanced IT solutions to SMBs and midmarket firms. The document is structured into six sections:

- What’s past is prologue – The Path to Digitalization

- Closing the gap between business priorities and IT challenges and the rise of digital

- Business Issues over the years – paving the route to digital transformation

- The rise of innovation – and digital – as a business focus

- IT challenges over the years – paving the route to digital transformation

- What’s future is epilogue: Connected Business