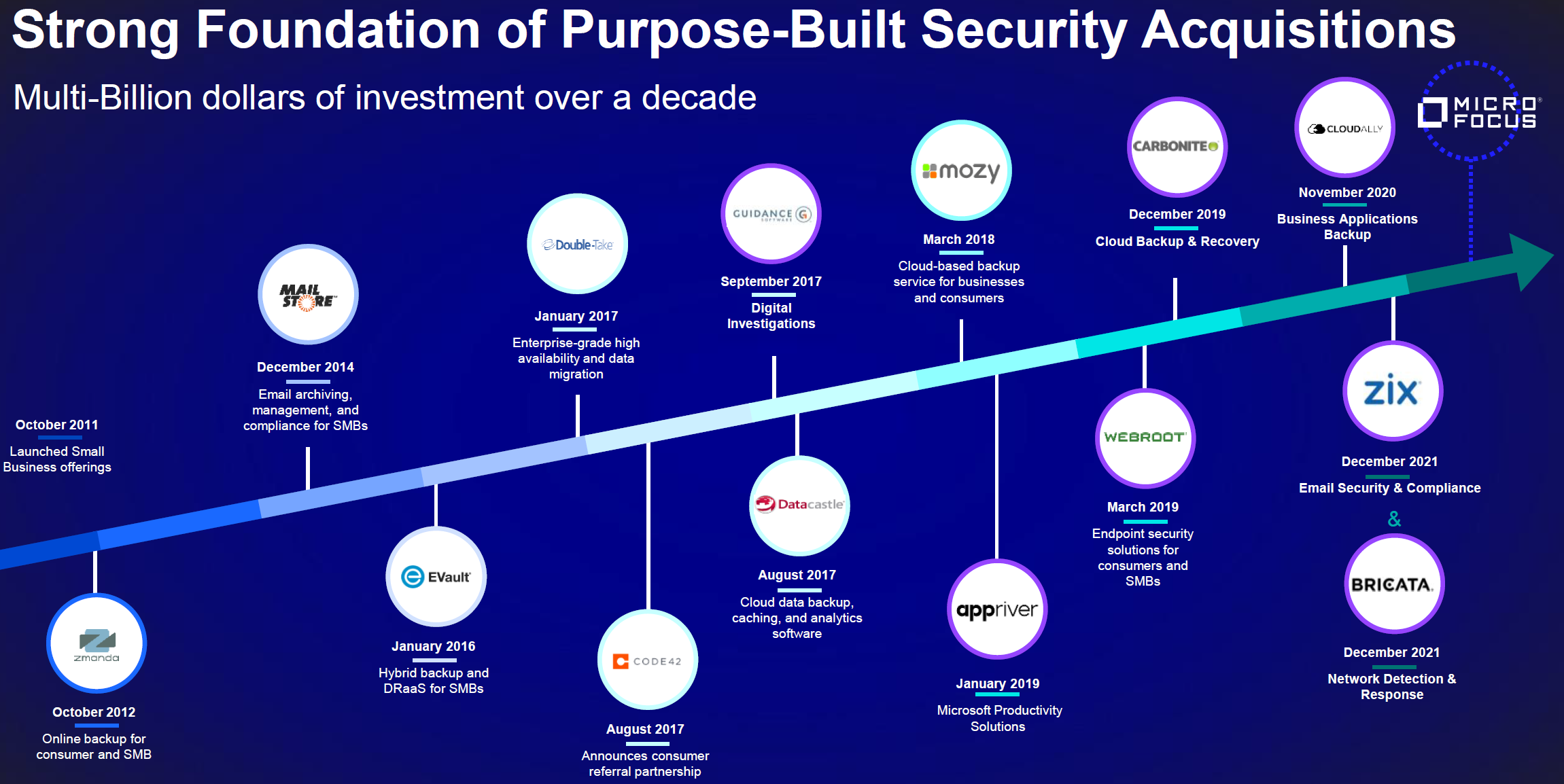

OpenText's transformation from a Canadian document management company to one of the world's leading software providers is nothing short of remarkable. The driving force behind its growth has been a focus on cloud-based solutions, which led the company to go on an acquisition spree, bringing several specialized companies/brands under its umbrella. Cybersecurity is one arena where OpenText has taken a deliberate approach over the last decade with multi-billion dollars of capital investment to bring together critical purpose-built solutions to provide holistic coverage to its customers.

The company’s acquisition of data protection provider Carbonite (ninth cloud-specific acquisition overall) and endpoint/threat intelligence software provider Webroot marked a significant milestone in its quest to create a single, unified, and robust security portfolio.

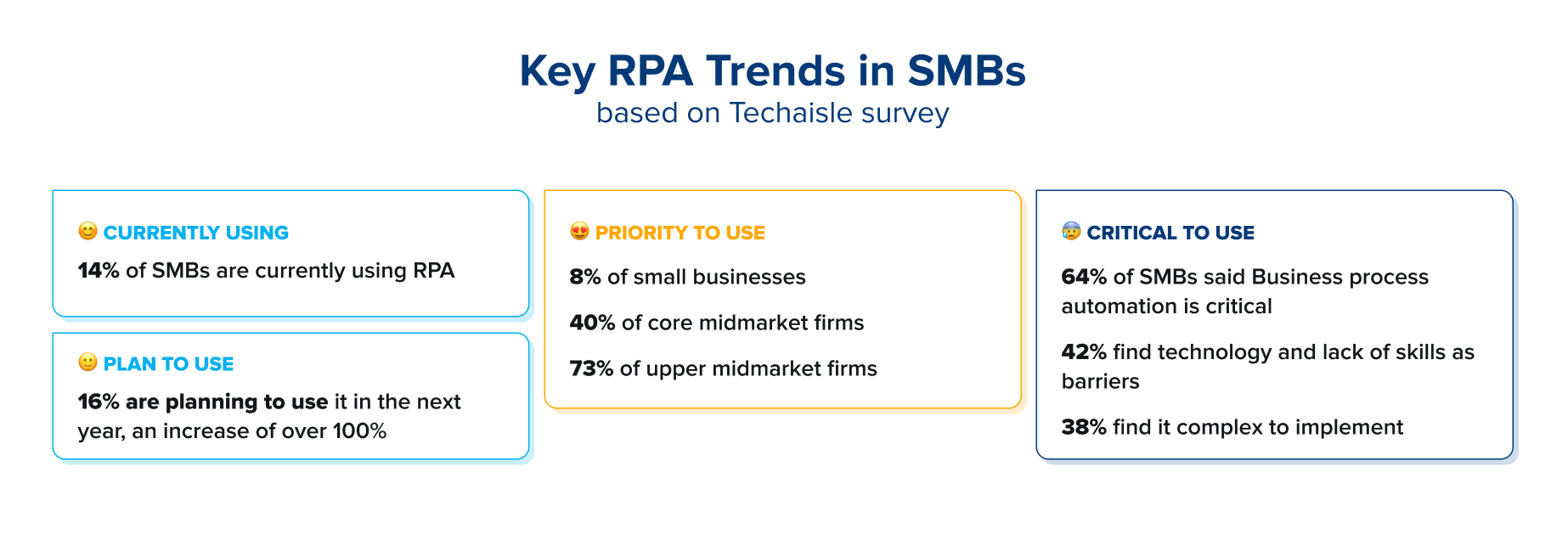

With the Carbonite and Webroot acquisitions, OpenText became a go-to option for managed service providers (MSPs) and small and medium businesses (SMBs) seeking a one-stop shop for security and data protection, filling a void in the market with its broad portfolio. Experts have opined on OpenText’s offerings: “It's one vendor, one brand, one program, one partner strategy, one go-to-market, so small customers and partners don't need to work with multiple vendors. OpenText Cybersecurity can provide all of it."

However, this was just the beginning. OpenText's subsequent acquisitions of email encryption software provider Zix, security software provider AppRiver, Network Detection and Response provider Bricata, and enterprise software provider Micro Focus further strengthened its position in cybersecurity. The approach to consolidate all security and data protection services in a single platform – serving as the foundation to deploy the right capabilities and manage and administer their environment has made things easier for customers of all sizes. In addition, OpenText's comprehensive portfolio provides a robust and reliable option for businesses seeking to enhance their cyber resiliency. In the following sections, we will explore OpenText's trajectory to becoming one of the leaders in the cybersecurity domain.