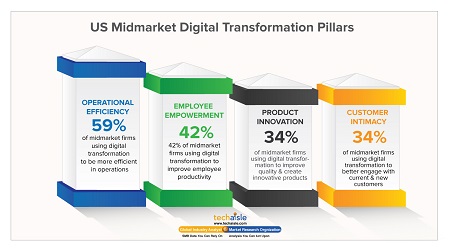

Operational efficiency, employee empowerment, customer intimacy and product innovation form the four pillars of digital transformation within US midmarket (100-999 employees) firms. Techaisle’s unique study, US Midmarket Digital Transformation Trends, provides readers with statistically-significant and current data on digital transformation. A sample of 876, outstanding for a single country, midmarket-specific research initiative, considered accurate at a 95% confidence level (19 times of 20) at a margin of error of +/- 3.3%. The study reveals details about the four foundational pillars of digital transformation along with drivers, motivations, challenges, inhibitors, and business outcomes.

The first step in understanding the potential of a technology trend is identifying the extent to which technology aligns with or supports executive ‘care-abouts’: technologies that connect directly to C-level objectives are most likely to obtain corporate support. Taken together, the size/robustness of the data makes it the most reliable source of information on digitalization adoption in the US midmarket (100-999 employees).

The survey data illustrates why digital transformation is so prominent in executive-oriented IT discussions. More than one-third of survey respondents indicate that digital transformation supports each of four critical corporate priorities. Nearly 60% see digital transformation as contributing to operational efficiency – streamlining processes within the business. Over 40% believe that digital transformation contributes to employee empowerment, which is in turn viewed as important to productivity and to attracting and retaining millennial employees. Just over one-third view digital transformation as a key to developing customer intimacy, enhancing relationships with existing and new customers. And a similar proportion connect digital transformation with product innovation, positioning it as a means supporting innovation and improving output quality.

These findings represent fertile ground for IT marketers. They support messaging aimed at senior executives, which is often a difficult-to-engage target audience for IT suppliers. The same findings can support messaging to IT management, couched in terms that highlight the path to (and importance of) positioning IT as a strategic resource within the business.

Survey data contained in the report not only provides material enabling IT marketers to connect messaging to a hard-to-reach target audience, its also provides firms offering digital transformation services evidence of vast untapped potential.

Survey data shows, more than 40% of prospective midmarket customers already take a Holistic view of IT/business strategy and infrastructure; a similar proportion recognize that digital transformation is important to, but a (small) subset of, strategic planning – not critical across the entire business. Most of the remaining population reports that their digitalization strategy is ‘Siloed’, with individual initiatives not coordinated centrally or integrated with overall corporate strategy.

The ‘glass half full’ aspect of contained in the data is that less than 5% of the firms surveyed report that digital is not seen as core to operations or that they are ‘in the shadows’, with no current strategic digital initiatives within their organizations. Suppliers focused on strategies emphasizing the criticality of digitalization should note that 55% of the US midmarket business population is still evolving towards a holistic view of digital/business operations impacting every aspect of their processes, and that the most advanced 41% has already made this connection.

The report covers:

- Midmarket segment details by digitalization strategy

- Drivers and expected outcomes of digitalization initiative

- Primary inhibitors to digitalization by segments

- Level of digitization of various processes

- Level of customer facing digital presence

- State of IT priorities, IT concepts