Techaisle Blog

Identifying key benefits associated with SMB Big Data initiatives

Intrinsic to positioning any IT-enabled solution is an understanding of the benefits that the customer anticipates obtaining from deployment of the technology. Buyers need to understand how the solution helps them to increase revenues, cut costs, improve efficiency or otherwise enhance shareholder value; vendors need to be able to position their offerings as a means to achieving these objectives.

While there is a close relationship between “analytics” and “Big Data” – and they are often conflated in the press – the two technologies follow somewhat different paths into SMB user environments. Techaisle research has found that analytics solutions tend to be driven by BDMs – business users looking for better ways of approaching high-priority business issues. In some cases, this requires access to vast quantities of high-velocity, variegated sources, which in turn demands a Big Data solution – but in contrast to analytics adoption, Big Data initiatives rely heavily on IT for implementation and ongoing management, and represents a solution area that requires collaboration between BDMs and ITDMs.

While SMB Big Data buyers view support for (predictive) analytics as their top acquisition driver, they also have distinct needs and preferences that suppliers must consider in building a sales and marketing strategy.

The drivers prompting Big Data investments are largely tied to revenue generation. However, anticipated benefits span a much wider range of outcomes, with “increased sales” ranking behind improved customer experience, operational efficiency, new product innovations, product/service quality and risk reduction. Big Data suppliers to take both perspectives into account when developing communications for the Big Data market: there is a focused set of issues (largely revenue based) that drive the need for Big Data investment, but prospective customers expect to obtain a relatively wider range of benefits from the investment.

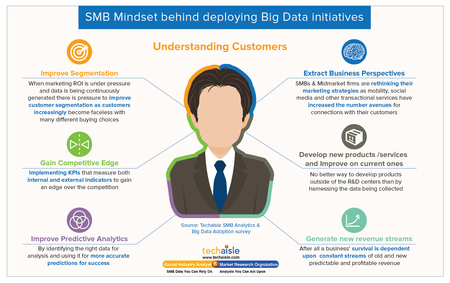

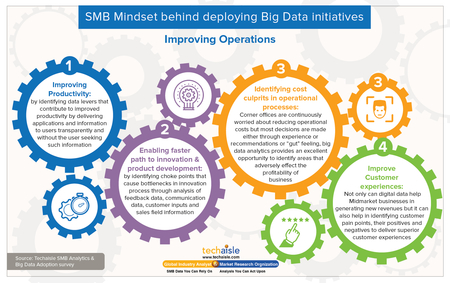

The above observations beg an important question: what should Big Data suppliers focus on as they look to position Big Data initiatives for SMB customers? Using data from its SMB Analytics Adoption survey, Techaisle has assembled two infographic-style guides to initiatives geared towards the key outcomes of better understanding customers and improving business operations. Both provide guidance to marketers looking to identify ways of aligning messaging (and offerings) with SMB customers.

There are several paths to creating Big Data solution demand. Two that are linked to subjects covered in the Analytics Adoption survey are allying with high-profile suppliers (identified through a question on top-of-mind awareness) and understanding the underlying platforms that SMB buyers are using as the basis of their Big Data strategies.

When you subscribe to the blog, we will send you an e-mail when there are new updates on the site so you wouldn't miss them.