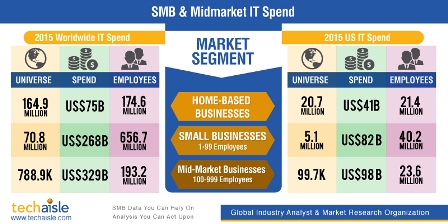

Techaisle forecasts that global SMB IT spend could very well reach US$597 billion in 2015 which is an average of US$700 per full-time employee and slightly over US$8K per SMB business. Corresponding US SMB IT spend will most likely be US$180 billion in 2015. Techaisle defines SMBs with 1-999 employees.

At worldwide level, 42% of SMB employees will be mobile by end 2015. US will have the highest percent of SMB mobile employees at 53% and Asia/Pacific excluding Japan will be at 45%.

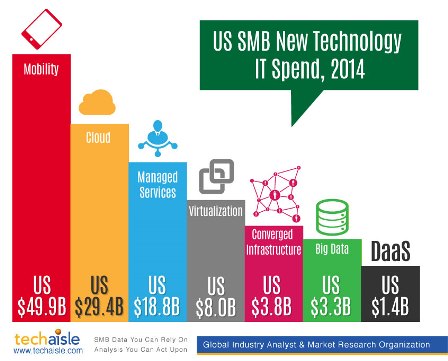

Going back a year, the 2014 combined cloud and managed services spend by US SMBs was US$48 billion representing 27% of total US SMB IT spend.

The global small and mid-market businesses, SMB (1-999 employee size) market has been the growth engine for the IT industry at large. The reason is quite simply that SMBs account for over 80 percent of businesses in any country – developed or developing. And over the last few years there has been an ongoing change in SMB IT priorities – Techaisle calls this as “Value Shift”. It signals the change in priorities from Enablement to Empowerment and refers to the new priorities among SMBs to invest in tools and technologies that allow their employees to make better business decisions, improve market reaction time and better serve their customers. In other words, SMB business executives are looking to improve return on Human Capital as a way forward.

No doubt the trend is towards increased spending on cloud and mobility but there are some other key spending trends to note:

-

Increasing outsourcing: There is no let-up in outsourcing of custom application development and support, in fact, cloud and mobility are feeding into an increasing trend towards services outsourcing. Over 40% of midmarket firms and nearly 1/3rd of small businesses are planning to outsource cloud migration services. 20% of midmarket firms are currently outsourcing mobile app development and another 31% are planning to outsource. (Source: Techaisle 2015 SMB & Midmarket Cloud Adoption Study). In addition to cloud and mobility midmarket firms are increasing their outsourcing for big data and analytics projects.

-

Cloud budget allocations becoming noteworthy: Microbusinesses (1-19 employees) are allocating a majority of IT budget to cloud-delivered services, while other small and midmarket firms are allocating between 5%-15% of IT budgets to cloud and which is expected to double in the next 2 years. (Source: Techaisle 2015 SMB & Midmarket Cloud Adoption Study) However, mobility spend is becoming a grey area as SMBs do not have very clear idea of spend on mobility because it includes both company and employee activity. (Source: Techaisle 2015 SMB & Midmarket Mobility Adoption Study)

-

Significant Shadow IT spend: Global shadow IT spend (expenditures made by business management without IT involvement) within SMBs will amount to US$100 billion in 2015 which is 17% of IT spend. The corresponding US figure will be US$27 billion in 2015. (Source: Techaisle 2015 SMB & Midmarket - IT vs. LOB: Balance of IT Purchase Authority & Decision Making)

-

LoB driving IT spend and its involvement growing substantially: Technology spending under Line of Business management within US SMBs will reach $99 billion, a figure that is greater than Microsoft’s annual revenue, twice the revenue of Cisco, and nearly 20 times the revenue recorded by Salesforce. IT purchase authority is shifting to line of business management, 4 out of 9 IT investment areas are being led by business rather than IT in midmarket firms and 7 of 9 within small businesses. (Source: Techaisle 2015 SMB & Midmarket - IT vs. LOB: Balance of IT Purchase Authority & Decision Making)

-

Continuing server demand: Use of private and hybrid cloud is driving demand for on-premise servers with 60% of midmarket firms and 37% of small businesses already using cloud servers are also planning to buy on-premise servers (Source: Techaisle 2015 SMB & Midmarket Cloud Adoption Study)

However, not all businesses within the same employee size category have the same average spending on IT. Analysis of data and proprietary segmentation from the Techaisle SMB 2015 survey identifies six IT Sophistication end-user segments within SMBs (Source: Techaisle SMB & Midmarket IT Sophistication Segmentation):

-

Pre-IT Segment: a group of companies that has no internal IT resource at all, which is found within the small (1-99 employees) business segment.

-

Basic IT Segment: companies focused on delivering core IT capabilities to internal users, but which lack the ability to expand into more sophisticated applications and technology types. Basic IT firms are found in both small (1-99 employees) and midmarket (100-999 employees) businesses.

-

Advanced IT Segment: companies that have progressed beyond core applications and which are actively working with more sophisticated solutions, including “second order” (business intelligence, ERP) and emerging (e.g., location-based intelligence) technologies. There are clusters of Advanced IT firms in both the small business and midmarket business segments.

-

Enterprise IT Segment: companies where IT itself is run as a business, providing enterprise-grade support to all aspects of the organization. The Enterprise IT cluster is found within midmarket companies, but not within small businesses.