Techaisle Blog

SMB Collaboration advocacy - the coming changing of the guard

Staffs within IT suppliers often like to remind each other that “people sell to people.” Generally, this is said to remind IT suppliers that marketing programs alone won’t (generally) make a B2B solution successful, that sales staff are important as well. The other side of the equation is important too, though: who within the SMB should IT suppliers target for collaboration solutions?

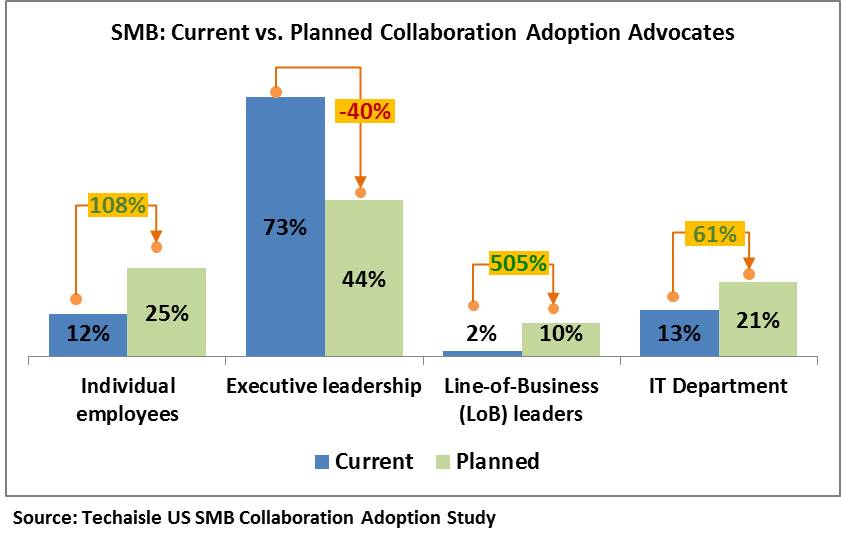

In SMB Collaboration Adoption Tends survey, Techaisle asked ITDM and BDM respondents, “who is the primary advocate for your organization’s collaboration efforts?” Looking at collaboration today, executive leadership is the key driving force behind collaboration solution investments. In many ways, this makes sense: collaboration has been positioned as a platform, and as a result, represents a major investment; and collaboration platforms become a central, every-day resource touching all users within an organization, meaning that senior leadership’s influence may be needed to align all stakeholders behind a single course of action.

Current vs. Future SMB Collaboration buyers

When we compare current users vs. future SMB buyers, though, we get a different perspective on this issue. Executive leadership will continue to be the primary driver of collaboration solution initiatives, but new solution initiatives are increasingly being driven from other quarters.

Within both small and midmarket businesses, we see individual employees stepping up as collaboration solution champions – most likely because they are looking for ways to bring current activities (such as with Dropbox or Skype) into a corporate framework. We see line of business (LoB) management and IT management also becoming more involved in driving collaboration initiatives in small business, though the influence of LoB management over new collaboration solutions in midmarket accounts is expected to decline somewhat, with only 10% of new buyers identifying LoB managers as primarily responsible for collaboration efforts, vs. 14% of current US midmarket collaboration solution users. On the other hand, the LoB advocacy within small businesses increases as compared to current scenario.

Expanding the scope of buyers

It seems clear from this data that collaboration solution providers are experiencing a change in their markets. In the past, a marketing program targeted at executive management would have covered 50%-75% of the total opportunity. Today, while it is still important to deliver messaging to this group, suppliers need also consider individual staff members, IT management and line of business management in their strategies. Impetus for collaboration solutions is coming from a wider variety of sources in a higher proportion of opportunities. Suppliers will need to adjust their marketing strategies to account for the different messages and marketing channels needed to cover this broader decision-making community.

Targeting the lead adopters: focus on the BDM

The more granular approach to a number of questions asked within the study yields a consistent result: for the most part, suppliers should focus their messaging on business leaders rather than on IT staff. Business leaders were nearly four times as likely as IT leaders to be viewed as the key forces in adoption of collaboration solutions – an extraordinary finding when one considers that the respondent population was comprised roughly equally of ITDM and BDM respondents. The consistent message to suppliers is that collaboration marketing should be aligned with business needs first, and IT as a secondary consideration.

This guidance extends to other solutions with collaborative aspects as well. For example, in the results of the same question for “social media platforms and solutions”, the BDMs are viewed consistently as the key drivers of solution adoption – and here again, suppliers need to target marketing messages to address BDM needs. Unlike back-office technologies, collaboration (as a platform/framework and as an essential element of related solutions like social media) needs to be positioned as a business solution, and not as a technology system.

When you subscribe to the blog, we will send you an e-mail when there are new updates on the site so you wouldn't miss them.